MONEY :

Money is an economic liquid asset used to buy goods and services .It functions as a generally recognized medium of exchange for transactional purposes in an economy. Currency is the basis of economy in the sense that its movement in the economy is the barometer of the health of economy.

CLASSIFICATION OF MONEY :

Money can be classified on various parameters like :

- Liquidity of different money forms EG M0.,M1,M2,M3....

- Backing of money by different reserves in the form of metal or foreign currency and its relationship between the value of money as a commodity and the value of money as money.

Based upon its money as a commodity and the value of money as money, It is classified as Full-bodied Money, Representative Full-bodied Money and Credit Money.

Full-Bodied Money:

- Full-bodied money refers to any unit of money, whose intrinsic value and face value are equal.

- For example, During the colonial period, 1 rupee coin was made of silver metal and its monetary value was equal to its commodity value.

Representative Full-bodied Money:

It refers to money which is usually made of paper but 100% backed by metallic reserve of gold or silver.

The value of representative full-bodied money (face value of currency) is much higher than its value as a commodity (paper).

Credit money:

- It refers to the money whose intrinsic value (as a commodity) is much lower than its face value, i.e. Money Value (2000 Rs) > Commodity Value (value of paper).

- In case of credit money, the currency note is not 100 % backed by any metallic reserve or any foreign currency.

- In the modern economies, countries are having currencies in the form of credit money .

For example, face value of Rs 2000 note is Rs

2000, but we would get a much lower value if we sell the note as a piece of paper.

Examples are Token coins ,currency notes ,Credit cards, bank deposits.

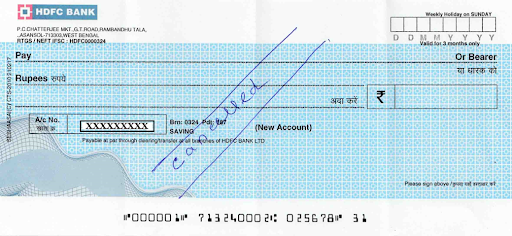

Optional Money :

- Money which is ordinarily accepted by the people for final payments, but has no legal sanction behind it.

- This type of money does not have status of legal tender as it is not have guarantee of central bank.

- No one can be forced to accept them but they are generally accepted because people have confidence in the credit of these types of paper.

- Credit instruments like cheques, bank drafts, bills of exchange, promissory notes etc. are optional money.